skip to main |

skip to sidebar

~

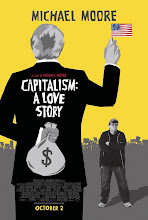

Five life insurance industry organizations have joined to combat what they say is a mischaracterization of corporate-owned life insurance by Michael Moore in his movie, “Capitalism: A Love Story.”

The documentary includes a small focus on DEAD PEASANT INSURANCE, which has led to additional media reports alleging that business owners are obtaining life insurance policies on their low-level employees without their knowledge.

Nearly two decades ago, some business owners used COLI to obtain broad coverage of low-level workers – “janitor’s insurance” or “dead peasant’s insurance” – not for the insurance benefits, but as a tax shelter.

But the groups say tax laws, implemented in 2006, require employers to take out COLI only on their highly compensated employees after notice and informed consent. That approach, they say in a joint statement, has been a common practice in the industry, despite Moore’s portrayal.

(Since companies are not required to disclose these secret insurance policies, there is no way to disprove what these insurance giants claim in order to continue this disgusting practice and increase the insurance and corporate profits off of dead “peasant” employees. - Chimp)

~

~

The candymaker said it stopped taking out life insurance policies on employees in the '90s.

Michael Moore calls them "dead peasant" policies.

The Hershey Co. is not getting any kisses from Michael Moore's ironically titled new film, "Capitalism: A Love Story."

The documentary, which opened in Harrisburg on Friday, skewers the pursuit of profits as "evil." But Moore reserves some of his harshest scorn for a little-known corporate practice of insuring the lives of even low-level employees, then reaping benefits when those employees die.

Among the companies Moore cites as profiting from the so-called "dead peasant" insurance policies is the Hershey Co.

The Derry Twp.-based chocolate maker is mentioned in the film by name and listed onscreen along with about a half-dozen other companies that Moore says engaged in the practice, which he sums up by saying:

"You're better off dead -- at least that's how some companies view their workers."

The film gives no other details about Hershey's activities, and Moore's footnotes from the film on his Web site do not mention Hershey.

Attempts to reach Moore's production company, Dog Eat Dog Films, were unsuccessful Monday.

Hershey, the nation's No. 2 candymaker, did benefit from life insurance policies on its employees, but discontinued the practice more than a decade ago, a company spokesman said Monday.

"We do not engage in the practice," Hershey spokesman Kirk Saville said. "We discontinued it in the mid-1990s."

Saville said he had no information on why the insurance policies were stopped or how many Hershey employees were insured with death benefits going to the company.

"That I don't know," he said. "That was a long time ago."

~

~

"Hey, we just want to make sure that when the janitor dies, our company doesn't go out of business. So we insure him for a few tax-free millions."

Many of us may not know it, but we may be worth more to our employers dead than alive.

The so-called dead peasant, or dead janitor insurance is insurance purchased by companies on low-level employees.

This practice is generally done without the knowledge of the employee. When the employee dies, the family receives no benefit. Instead the face value of the policy goes to the company, tax-free.

This insurance is also known as corporate-owned Life Insurance or COLI.

Prior to the 1980s, insuring lower level employees by corporations was not allowed; there was no “insurable interest” in the employees’ survival.

Companies could not argue there would be financial hardship if file clerks, janitors or nonessential managerial personnel perished.

The rules for insurability were designed to prevent life insurance from providing an incentive or avenue to profit from ones death.

Insurance companies aggressively lobbied state insurance departments to modify the rules.

The net effect allowed insurance companies to sell janitor insurance; without regulations or guidelines.

The rules in most states are unclear whether employers are obligated to inform workers if they are covered by COLI.

Insurance codes in most states provide little help, if any, to an employee in discovering out whether a company has insured them, or the amount of the death benefit.

Nor can family members ascertain if a current or past employer collected, or if they will collect.

~