skip to main |

skip to sidebar

~

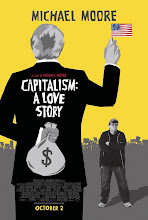

Five life insurance industry organizations have joined to combat what they say is a mischaracterization of corporate-owned life insurance by Michael Moore in his movie, “Capitalism: A Love Story.”

The documentary includes a small focus on DEAD PEASANT INSURANCE, which has led to additional media reports alleging that business owners are obtaining life insurance policies on their low-level employees without their knowledge.

Nearly two decades ago, some business owners used COLI to obtain broad coverage of low-level workers – “janitor’s insurance” or “dead peasant’s insurance” – not for the insurance benefits, but as a tax shelter.

But the groups say tax laws, implemented in 2006, require employers to take out COLI only on their highly compensated employees after notice and informed consent. That approach, they say in a joint statement, has been a common practice in the industry, despite Moore’s portrayal.

(Since companies are not required to disclose these secret insurance policies, there is no way to disprove what these insurance giants claim in order to continue this disgusting practice and increase the insurance and corporate profits off of dead “peasant” employees. - Chimp)

~

~

The candymaker said it stopped taking out life insurance policies on employees in the '90s.

Michael Moore calls them "dead peasant" policies.

The Hershey Co. is not getting any kisses from Michael Moore's ironically titled new film, "Capitalism: A Love Story."

The documentary, which opened in Harrisburg on Friday, skewers the pursuit of profits as "evil." But Moore reserves some of his harshest scorn for a little-known corporate practice of insuring the lives of even low-level employees, then reaping benefits when those employees die.

Among the companies Moore cites as profiting from the so-called "dead peasant" insurance policies is the Hershey Co.

The Derry Twp.-based chocolate maker is mentioned in the film by name and listed onscreen along with about a half-dozen other companies that Moore says engaged in the practice, which he sums up by saying:

"You're better off dead -- at least that's how some companies view their workers."

The film gives no other details about Hershey's activities, and Moore's footnotes from the film on his Web site do not mention Hershey.

Attempts to reach Moore's production company, Dog Eat Dog Films, were unsuccessful Monday.

Hershey, the nation's No. 2 candymaker, did benefit from life insurance policies on its employees, but discontinued the practice more than a decade ago, a company spokesman said Monday.

"We do not engage in the practice," Hershey spokesman Kirk Saville said. "We discontinued it in the mid-1990s."

Saville said he had no information on why the insurance policies were stopped or how many Hershey employees were insured with death benefits going to the company.

"That I don't know," he said. "That was a long time ago."

~

~

"Hey, we just want to make sure that when the janitor dies, our company doesn't go out of business. So we insure him for a few tax-free millions."

Many of us may not know it, but we may be worth more to our employers dead than alive.

The so-called dead peasant, or dead janitor insurance is insurance purchased by companies on low-level employees.

This practice is generally done without the knowledge of the employee. When the employee dies, the family receives no benefit. Instead the face value of the policy goes to the company, tax-free.

This insurance is also known as corporate-owned Life Insurance or COLI.

Prior to the 1980s, insuring lower level employees by corporations was not allowed; there was no “insurable interest” in the employees’ survival.

Companies could not argue there would be financial hardship if file clerks, janitors or nonessential managerial personnel perished.

The rules for insurability were designed to prevent life insurance from providing an incentive or avenue to profit from ones death.

Insurance companies aggressively lobbied state insurance departments to modify the rules.

The net effect allowed insurance companies to sell janitor insurance; without regulations or guidelines.

The rules in most states are unclear whether employers are obligated to inform workers if they are covered by COLI.

Insurance codes in most states provide little help, if any, to an employee in discovering out whether a company has insured them, or the amount of the death benefit.

Nor can family members ascertain if a current or past employer collected, or if they will collect.

~

~

By Chimpplanet

Sarah Palin got it partially right when she feared “death panels”. The part she didn’t explain is that death panels already exist and they are in the boardrooms of major blue chip American companies, like Walmart.

Unbeknown to the employees, many large companies take out “dead peasant” life insurance policies on them naming the company as the beneficiary. These policies continue active even after the employee leaves.

Two points come to mind here. One is that for the company to collect, they must keep track of their ex-employees for the rest of their lives so they can know when he/she dies so they can collect.

Second, if a worker moves around a lot, it’s possible that many companies may hold peasant insurance on this one worker and then the multiple payouts may be in the tens of millions of dollars. Wonder what’s the most any employee ever made for his employers.

The companies collect tens of thousands and even millions of dollars when the employees (current or past) die.

They often use this tax-free money to pay bonuses to their executives.

The “death panels” are the actuaries in each company who project how many employees will die in a given year so they can guess on how much gravy payouts the company will get.

The company directors get very upset if there is a short-fall on deaths and they celebrate when they exceeds death expectations.

You are worth more to your employer dead than alive.

********************

WEHAT IS "DEAD PEASANT" INSURANCE?

********************

WHAT WOULD STOP THESE COMPANIES FROM HIRING ASSASSINS FOR A FEW THOUSAND DOLLARS TO MAKE MILLIONS? HAVE THEY DONE IT ALREADY?

THAT'S WHY THE LAW DOES NOT ALLOW YOU TO TAKE OUT LIFE INSURANCE ON YOUR FRIENDS. WONDER IF THAT LAST ACCIDENTAL DEATH I READ ABOUT WAS REALLY AN "ACCIDENT".

~

~

Corporate vultures

I remember the story about Wal-Mart collecting $72,820.30 in life insurance on an employee, Karen Armatrout, who died of cancer while working at Wal-Mart.

At the time, I didn’t think to look deeper to see if this was a common practice among big corporations.

A Texas attorney, Michael D. Myers, sued Wal-Mart over the Karen Armatrout case and it was dismissed because it failed to reach the limit for a civil complaint to go before a federal judge.

However, Michael D. Myers had won a previous settlement in Oklahoma in a class action law suit brought by family members of the deceased Wal-Mart employees…..the settlement in OK was $5.1 million.

But, lawsuits appear to be few and far between.

Corporations Profiting on Employees’ Deaths

But, what’s going on? Corporations are lining their pockets off the life insurance they take out on employees who die.

Some of the companies who engage in this practice are: Wells Fargo, Bank of America, JP Morgan Chase, Dow Chemical, Procter & Gamble, Wal-Mart, Walt Disney and Winn-Dixie.

They carry policies that amount in the BILLIONS. “The Wall Street Journal reports that Bank of America and Wells Fargo both have $17 billion each in these life insurance policies. Chase has $11 billion.”²

Dead Janitors and Dead Peasants

To add insult to injury, the policies are nicknamed dead janitors or dead peasants insurance AND the insurance is used as a tax dodge….not to mention the benefits are used to pay bonuses to key executives.

~